– Financial Bill to widen tax net will go into effect after Buhari’s assent

EVIDENCE of tax payment will be a condition for operating a bank account from January, According to the Financial bill passed by the National Assembly.

The Bill, submitted to the lawmakers with Budget 2020 by President Muhammadu Buhari, is designed to improve financial operations of the country and streamline the tax regime.

It is expected to be signed with the budget before end of the month, to actualise the return to the January – December budget cycle.

According to a section of the Bill, banks will require anybody opening an account to provide his Tax Identification Number (TIN)

Those who already have accounts with banks will also be required to provide their TIN.

There are 30 million Bank Verification Numbers (BVN)-linked accounts.

The intention is to make sure that more people are captured into the tax net.

According to the Joint Tax Board, the tax identification number (TIN) is a unique identifier for an individual or a company for tax remittance.

The TIN is prepared by the tax office and issued for proper identification and verification.

Applying for TIN is free. The TIN generation process is real-time and should not exceed 48 hours after a request is submitted.

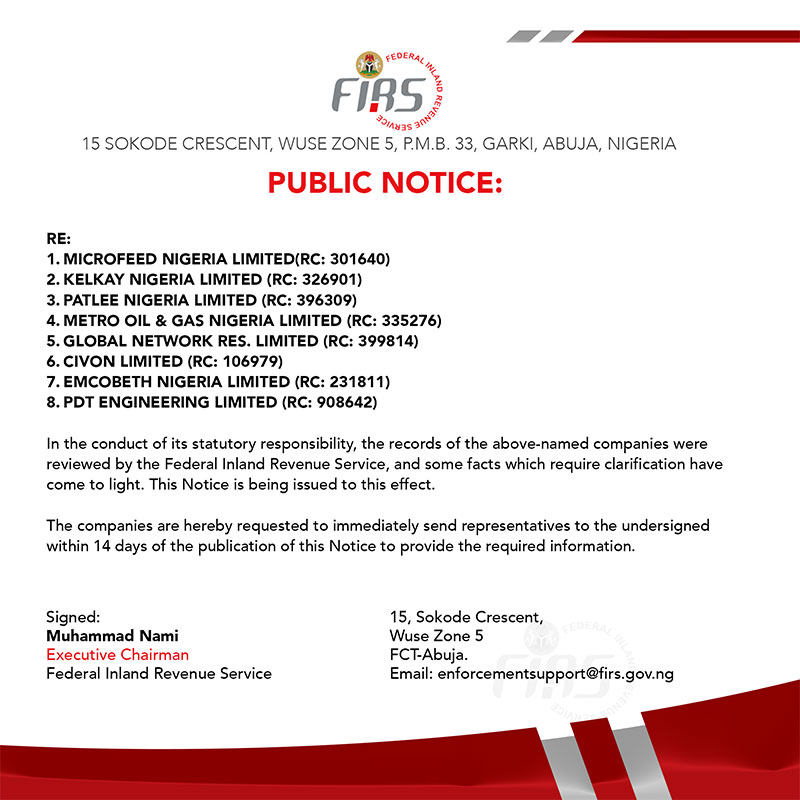

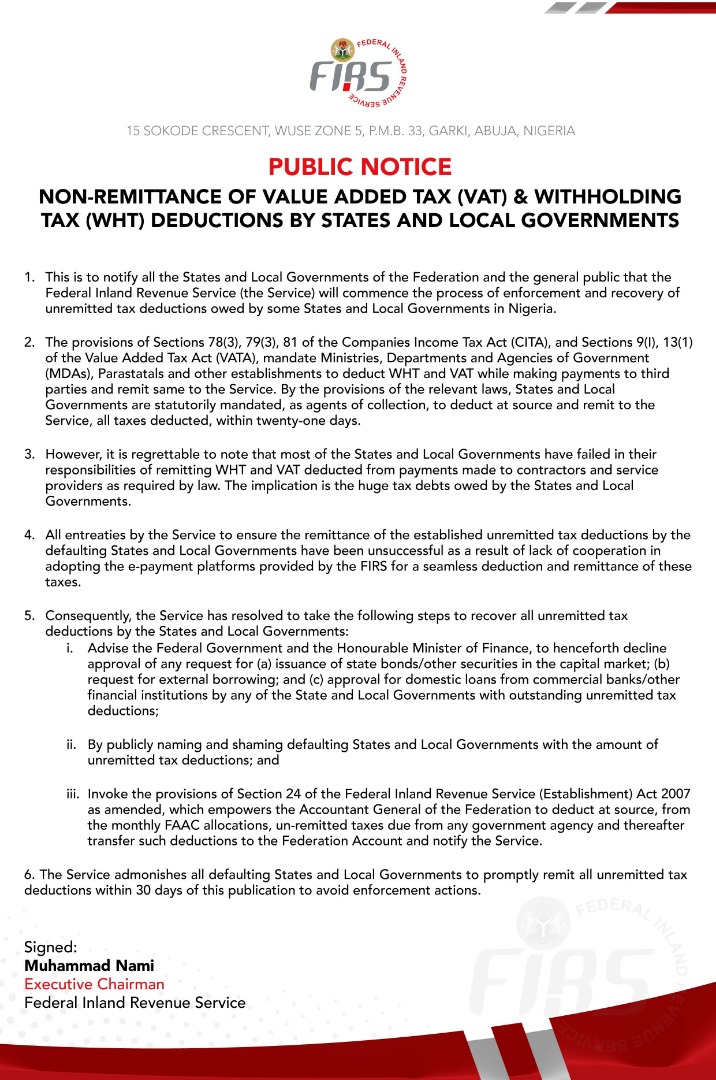

Another major feature of the Financial Bill is the hike in Value Added Tax (VAT) to 7.5 per cent from the extant five per cent.

Also in the bill, emails will be accepted by the tax authorities as a formal channel of correspondence with taxpayers.

The bill will also strategically “promote fiscal equity by mitigating instances of regressive taxation; reform domestic tax laws to align with global best practices; introduce tax incentives for investments in infrastructure and capital markets; support small businesses in line with the ongoing Ease of Doing Business Reforms; and raise revenues for the Government by various fiscal measures.”

Under the proposed Personal Income Tax Act: the bill will state that pension contributions no longer require the approval of the Joint Tax Board (JTB) to be tax-deductible.

The bill when signed into law, will remove the tax exemption on withdrawals from pension schemes except the prescribed conditions are met.

The bill will come up with a penalty for failure to deduct tax by agents appointed for tax deduction. This penalty is 10 per cent of the tax not deducted, plus interest at the prevailing monetary policy rate of the Central Bank of Nigeria (CBN).

The conditions attached to tax exemption on gratuities will be removed by the bill, meaning that gratuities are unconditionally tax exempt. The duties currently performed by the Joint Tax Board (JTB) as it relates to administering the Personal Income Tax Act, will now be performed by the FIRS.

Another penalty that will come into effect when the bill becomes law will be the penalty for late filing of the Value Added Tax (VAT) returns.

The penalty for failure to register for VAT will be reviewed upwards to N50,000 for the first month of default and N25,000 for each subsequent month of default.

The penalty for failure to notify FIRS of change in company address will be reviewed upwards to N50,000 for the first month of default and N25,000 for each subsequent month of default. This penalty also covers failure to notify FIRS of permanent cessation of trade or business.

Similar to the VAT amendment, the bill is also introducing Capital Gains Tax (CGT) exemption on Group reorganisations, subject to the following conditions being met.

They are:

- Assets are sold to a Nigerian company and is for the better organisation of the trade or business;

- The entities involved are within a recognised group 365 days before the transaction, and the relevant assets are not disposed earlier than 365 days after the transaction.

The current practice is that companies send an approval request letter under CITA S29(9) to the FIRS, and include a CGT exemption request. Currently, the CGT Act imposes CGT on compensation for loss of employment above N10,000.

The bill seeks to expand the coverage of this provision by renaming it “compensation for loss” and increase the minimum threshold from N10,000 to N10 million.